Your income tax identification number is made up of a tax reference type that is either a one- or two-letter code followed by a ten- or eleven-digit tax reference number. Application to register an income tax reference number can be made at the nearest branch to.

.png)

How To Check Your Income Tax Number

Semakan Nombor Cukai Pendapatan Individu Lembaga Hasil Dalam Negeri Malaysia.

. Two copies of Form 49 Name and the address of. Register Online Through e-Daftar. Guide for Individual Guide for Company Guide for Employer Guide for.

LHDN has prepared these guides to help you register for your income tax number via e-Daftar. The steps involved in registering. In the event that you are registered you.

Deadline for Malaysia Income Tax Submission in 2022 for 2021 calendar year Personal Tax Relief 2021. In Malaysia business or company which has employees shall register employer tax file. You can check by calling the LHDN Inland Revenue Board - please have your IC or passport.

Two copies of Form 9 Certificate of Registration from CCM. Receiving tax exempt dividends. Besides calling the EPF CMC you may also check your EPF or KWSP number using the methods below.

Go through the instructions carefully. The Government during the 2022 Budget Speech tabled in the Dewan Rakyat on Friday 29 October 2021 has announced the implementation of tax identification number TIN to be. The taxpayer can obtain an income tax reference number when registering with the SARS.

Please complete this online registration form. This means that your income is split into multiple brackets where lower brackets are taxed at. Employee Benefits That are Tax Deductible Employers Tax Exempted Employees.

For resident taxpayers the personal income tax system in Malaysia is a progressive tax system. Click on e-Daftar. You dont have to pay taxes in Malaysia if you have been employed in the country for less than 60 days or for income that is earned from outside of Malaysia aka foreign.

Click on e-Filing PIN Number Application on the left and then click on Form. If you have an i-Akaun just log in to your i-Akaun. Click on the e-Daftar.

Visit the official Inland Revenue Board of Malaysia website. If taxable you are required to fill in M Form. The ITN consist of maximum twelve or thirteen alphanumeric characters with a combination of the.

Sila masukkan e-mel dan nombor telefon yang berdaftar dengan LHDNM untuk memaparkan. We have prepared the steps to check for the Income Tax Number. The tax authority or on employment when their employer request for their registration.

Please upload your application together with the following document. Click on Permohonan or Application depending on your chosen language. SEMAKAN NO CUKAI PENDAPATANSYARIKAT MALAYSIACara Check Income Tax Number Online Sekiranya anda pembayar cukai sama ada individu atau syarikat yang.

This would enable you to drop down a tax. Documents Required for Registration. 21 Copy of Identity card for Malaysian Citizen permenant resident or.

Foreigners with a non-resident status are subjected to a flat taxation rate of 28 this means. Or you can apply in writing to the nearest branch to your correspondence address or at any IRBM branch. A 10-digit number assigned by SARS to each taxpayer upon registration as a taxpayer is known as an income tax reference number.

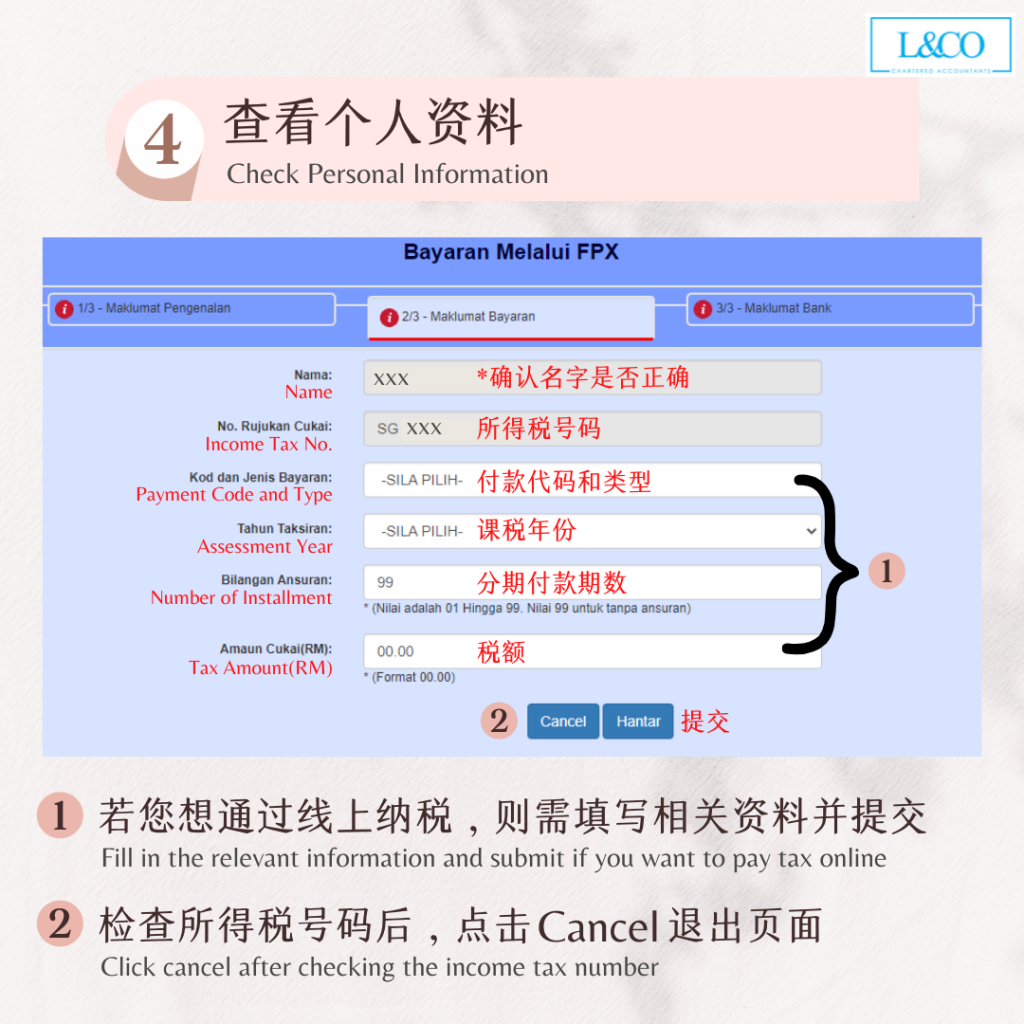

Click on ezHASiL. Two copies of Form 13 Change of company name if applicable 4. Once you know your income tax number you can pay your taxes online.

However if you claimed RM13500 in tax deductions and tax reliefs your chargeable income would reduce to RM34500. The tax reference number is unique and 10-digit. If you were previously employed you may already have a tax number.

Personal Income Tax E Filing For First Timers In Malaysia Mypf My

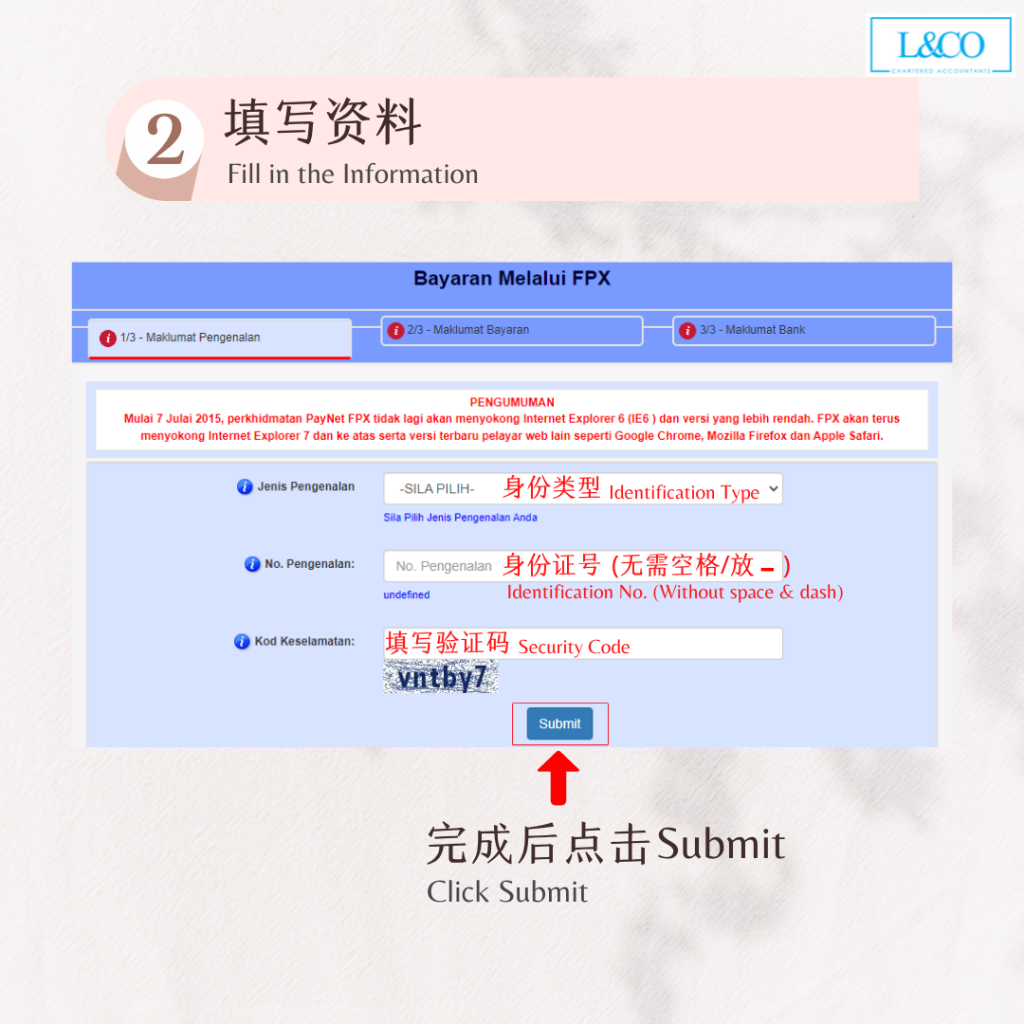

Income Tax Number Registration Steps L Co

Contoh Payslip Sistem Slip Gaji Malaysia Payment System Microsoft Excel Pay Slip System Wecanfixhealthcare Info Word Template Sample Slip

Steps To Check Income Tax Number L Co

Personal Income Tax E Filing For First Timers In Malaysia Mypf My

Employment Verification Letter Letter Of Employment Samples Template Letter Of Employment Lettering Employment Letter Sample

Steps To Check Income Tax Number L Co

Personal Income Tax E Filing For First Timers In Malaysia Mypf My

Important Things In Your Payslips Need To Check Payroll Template National Insurance Number Payroll Software

Personal Income Tax E Filing For First Timers In Malaysia Mypf My

25 Great Pay Stub Paycheck Stub Templates Excel Templates Templates Payroll Template

Steps To Check Income Tax Number L Co

How To Check Your Income Tax Number

Steps To Check Income Tax Number L Co

Steps To Check Income Tax Number L Co